Idaho Falls Disability Insurance

The ability to work and earn a living makes everything else

possible. It’s our most valuable asset and it deserves protection. Our income

earning potential can be protected with disability income insurance. Disability

income insurance provides income if you are unable to work because of an

illness or injury.

Needs for Disability

When

most people hear the word “disability” they automatically think of wheel

chairs, or someone being stuck in bed with a spinal injury. While this type of event is indeed disabling,

there are other less visible causes of disability that should be

considered when seeking an Idaho Falls disability insurance plan. Perhaps we should change the

wording to “sick or hurt and unable to work”.

No one expects a serious injury or illness to strike, but

disability can happen to anyone at any time. Disabilities are not usually the

result of an accident. The four most common causes of existing long-term

disability claims in 2012 were:

- musculoskeletal

system and connective tissue diseases (30.7%)

- nervous

system and sense organs diseases (14.2%)

- circulatory

system diseases (12.1%)

- cancer

(9.0%)

Medicine

has made great strides in helping us to outlive conditions that in times past

would have proven to be fatal. We have a

“good news/bad news” scenario playing out.

The good news is that people are living longer, the bad news is that

diseases which used to cause death are now leaving us disabled. This is food for thought a you consider an Idaho Falls disability insurance plan from Eagle Cap Insurance.

According

to a 1999 study by the National Center for Health Statistics, deaths due to

hypertension are down 73%, but disabilities due to the same are up 70%. Deaths due to heart diseases have decreased

by 29%, but disabilities caused by the same are up 44%. If the statistics for hypertension, heart

disease, cerebrovascular disease and diabetes are combined, deaths have

decreased by 32%, but disabilities have increased 55%. Additionally, the number of disability claims

for stress and depression is up considerably.

If

the potential for losing your ability to work is so significant, should we not

act to protect ourselves against the economic consequences of it?

Are you a gambler?

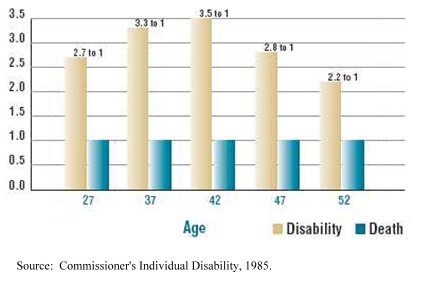

If

you were to go to Las Vegas and the odds of winning were one in three, would

you play? From the chart below you will

see that the odds of “winning” when it comes to becoming disabled are about

that. The chart illustrates that an

individual’s chances of disability are 2 to 3 times greater than death

during their working years

Are other options enough?

If you have group long-term disability insurance through your

employer, that’s a valuable foundation and a good start. But income from group

long-term disability insurance is taxable and is sometimes not enough.

Individual disability income insurance fills in the gaps. And you own the

policy. It’s yours to keep whether you change employers or not.

You don’t hesitate to insure your home, your car or other

valuables, so why wouldn’t you protect your income with disability insurance? Think of it as insurance

for your paycheck.

With disability income insurance in place, should the “unthinkable” happen and/or

you become very sick or hurt and cannot work for an extended period of time,

you would receive monthly payments to pay your bills and continue to pay your

bills and continue to live.

If

you are interest in knowing more about Macro Economic Planning and how to

coordinate your financial decision with a finite amount of money, contact Eagle

Cap Insurance for a free consultation.